Saviano: “Insider andrà in onda nella peggiore Rai di tutti i tempi”

After the new Government was formed last year, the spread initially widened a lot and has since come in, leading commentators here to incorrectly think that Italy might not be being unduly punished for its policies. A comparison with Spain, Portugal and Greece suggests otherwise. Further, the way in which the spread widened suggests that the market thinks the government is not running the economy well.

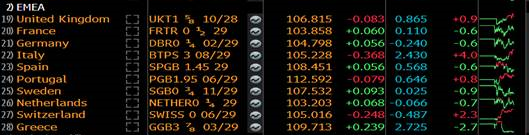

The first table shows the 10 year rates for a selection of European countries:

Bloomberg

We can see that Italy’s borrowing costs at 2.4% are low compared to historic levels but look at them compared to other, supposedly non-virtuous economies. Spanish 10 year debt yields 0.57%, Portuguese 0.65% and even Greek yields are only 2.73%. Italy is rated by the market at the same level as Greece! A multiple bankrupt with little functioning domestic industry beyond tourism. Italy is much worse than Portugal and Spain which were once viewed as its poor, and poorly run, neighbours.

Next, we can see the way the Italian 2 year spread has widened since the arrival of the current government from roughly 0.25% to 1.1% while Spain and Portugal have remained stable, though improving from 2017:

Bloomberg

The market is rewarding countries that are doing well, i.e. Spain and Portugal. This is not a generalised rout or a blockade of the Mediterranean by the Anglo-Saxons, it is targeted against the current government. They are being they are doing a bad job.

Now the current government will argue that the market does not understand it and that its policies will lead to growth. But what of the counterfactual? How much more money would they have to spend if they had promised to keep with the previous government’s policies and the spread would have tightened to Spanish or Portuguese levels? The government would likely be paying around 0.8% less on 2 year debt and 1.5% less on 10 year debt and, given its debt maturity is around 7 years, would have refinanced around 14% of the amount of its debt at this lower rate, an average spread of 1% I will say. Debt/GDP is 130%, so 130% *14% refinanced * 1% lower spread = 0.2% saving which becomes 0.4% after 2 years, etc. The current government will have added 1% to the annual deficit by the end of the legislature if it carries on like this.

And then think of the repercussions on bank lending and its repercussions on business investment and the rates paid for mortgages. And then the repercussions on the price of bank shares in the stock market. First of all, the criminal management manages to blow a € 25bln hole in the capital of various Italian banks and then the Government sends the share price down by 30% creating a further € 25bln loss of wealth just for Intesa and Unicredit shareholders, maybe not permanent as with Pop Vicenza but still.

Devi fare per commentare, è semplice e veloce.