Innovazione

Big tech is becoming increasingly capital intensive due, I think, to the cloud

We imagine that the big tech companies we see every day are capital light since traditionally they derived their revenues from intangibles like software and services. Yet, there has been a fundamental shift over the past 5 years as they have moved their services to the cloud that has led to an explosion in capital intensity at the most important big tech firms (Apple, Facebook, Google and Microsoft are considered here as well as Amazon Web Services) which doesn’t seem to have been appreciated by analysts or the general public. Inherently, if the software or the service has been moved from a person’s or a company’s pc or network onto the network of the service provider, the service provider has to replicate the hardware which the person or company held. Microsoft, for example, no longer provides you with software but software maintained on its servers. These need to be bought and this is causing a noticeable change in the balance sheets of these companies.

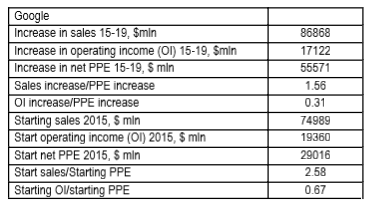

I look at the Plant, Property and Equipment by company and their sales and operating income. The figures are as follows by company:

CapitalIQ, my estimates

Google started off with $ 75bln of sales and $ 19bln of operating income off a PPE base of $ 29bln, generating $ 2.58 of sales and $ 0.67 of operating income for every $ of net PPE. In the years from 2015 to 2019, it increased sales by $ 87bln, operating income by 17bln and PPE by $ 56bln meaning sales only increased by $ 1.6 for every $ of extra PPE and operating income $ 0.31.

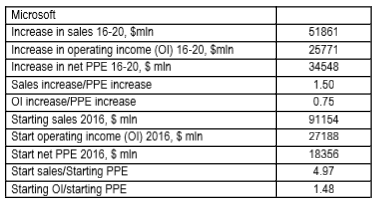

CapitalIQ, my estimates

Microsoft started off with $ 91bln of sales and $ 27bln of operating income off a PPE base of $ 18bln, generating $ 4.97 of sales and $ 1.48 of operating income for every $ of net PPE. In the fiscal years from June, 2016, to June, 2020, it increased sales by $ 52bln, operating income by 26bln and PPE by $ 35bln meaning sales only increased by $ 1.5 for every $ of extra PPE and operating income $ 0.75.

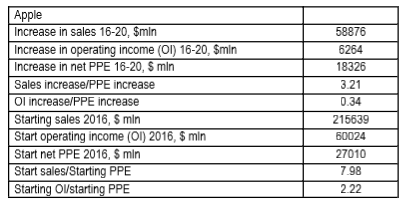

CapitalIQ, my estimates

Apple started off with $ 216bln of sales and $ 60bln of operating income off a PPE base of $ 27bln, generating $ 7.98 of sales and $ 2.22 of operating income for every $ of net PPE. In the fiscal years from September 2016 to September 2020, it increased sales by $ 59bln, operating income by 6bln and PPE by $ 18bln meaning sales only increased by $ 3.2 for every $ of extra PPE and operating income $ 0.34.

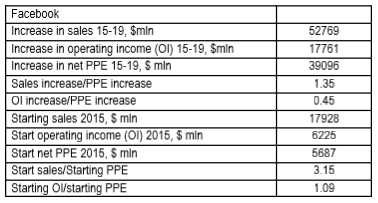

CapitalIQ, my estimates

Facebook started off with $ 18bln of sales and $ 6bln of operating income off a PPE base of $ 6bln, generating $ 3.15 of sales and $ 1.09 of operating income for every $ of net PPE. In the years from 2015 to 2019, it increased sales by $ 53bln, operating income by 18bln and PPE by $ 39bln meaning sales only increased by $ 1.35 for every $ of extra PPE and operating income $ 0.45.

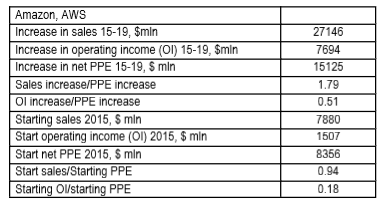

I include Amazon Web Services somewhat hesitantly, but for the sake of completeness, because I think the increase in PPE has mainly been driven by an increase in operating leases which are not included in the company’s figures for PPE by segment. I think the figure for the increase in PPE should likely be $ 15-20bln higher:

My estimates, Amazon 10K

Amazon Web Services is the only company where sales and operating income have increased more in the 2015-2019 period than they had previously.

If it is true that these companies are no longer as capital light as they once were because of the shift to the cloud, and therefore the trend is destined to continue as long as the shift to the cloud is considered advantageous and necessary for the person or company who decides to move their data there, then I think it is gradually going to start dawning on investors that these companies should not attract the multiples of the past. This is because the margins, cashflow and returns on invested capital will no longer be those of a pure software company but will decrease as the companies have to invest increasingly in the capital on which their software had been exclusively run.

Note – as offshoring production is no longer universally agreed to be good, I am not sure entrusting your data, and how it gets managed, to a 3rd party, and potential competitor, in a world where data is supposedly key to everything is a good thing. If I were Ocado or Veeva, for example, I would not entrust my data to a third party.

Thank you to Robin Moroney for a comment which prompted me to look into this.

Devi fare login per commentare

Accedi