Borsa

Amazon is a less efficient company than Wal-Mart

Or how getting up and going out shopping is more efficient than having someone come and deliver it for you.

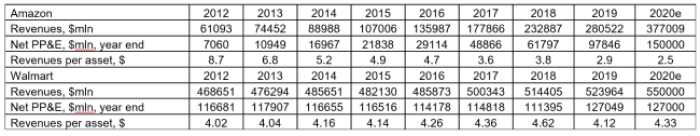

After all the hype about how the digital world would free us from the confines of capital and make the world more efficient, it may come as a surprise to learn that Amazon is now officially less efficient than Wal-Mart as its net assets, and likely gross, surpassed those of Wal-Mart while its sales remain around $ 180bln, or around 30%, lower than those of Wal-Mart. Here are the figures:

My estimates, PP&E = Net Plant, Property and Equipment

Amazon starts off by making $ 8.7 of sales for every $ of fixed assets and ends up at $ 2.5, almost 40% less than Wal-Mart which stays pretty stable just above $ 4 over the period.

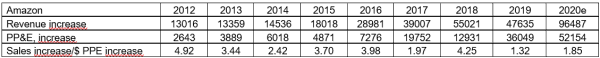

And not only has the efficiency of Amazon got worse, it has generally gotten worse faster as the company has grown. There are major dis-economies of scale with the business model:

My estimates

We are now at the stage where every $ the company invests in its fixed assets produces ongoing revenues of only $ 2. This is less than half the levels of Walmart and compares to around $ 4 in the years 2012-2016. Ordering online and having goods delivered may be more efficient for the consumer but it is a distinctly less efficient way of deploying capital. And it’s getting worse as Amazon expands.

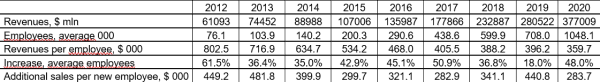

But this doesn’t just apply to the capital efficiency, it also applies to the operational efficiency. The people are becoming less efficient:

My estimates

The average employee in 2012 generated $ 803,000 of sales, the average employee this year will generate $ 360,000 of sales. The incremental employee this year will add $ 284,000 to sales. Despite all the talk of wrist trackers, of managing people as efficiently as possible, of adding capital to make the warehouses more efficient, this is all having no positive effect whatsoever.

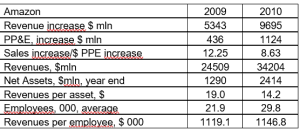

And to really hammer the point home, here’s 2009-10:

My estimates

The company was making over a million dollars per employee and every $ added to fixed assets was bringing in an extra $ 8.6 or $ 12.3 in sales, 4.6 – 6.6 times higher than what they will do this year.

My theory is that Amazon was the first victim of the digital revolution and did very well selling books, DVDs, and CDs out of a small number of warehouses until it had to diversify into selling everything as streaming killed DVD and CD sales. Selling online to people only works if you are selling them high value, durable, small volume goods when the customer is not time sensitive.

If you sell high volume, low margin goods, potentially in multiple packages, and promise to deliver them immediately so people don’t need to do it themselves, you are not going to be more efficient than just having those people go to the shops.

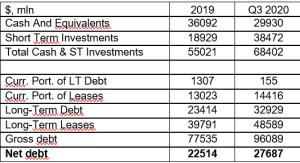

There’s a rebuttal at this point which is that Amazon is now finally making money and seeing net income grow. Yes, but what about cashflow. Now, in the first 9 months of this year, cashflow as defined by Amazon was $ 55bln and there were $ 31bln of investments for a net cashflow of $ 24bln. But cash at the start of the year was $ 55bln and is now $ 68bln, while gross debt and leases have gone from $ 78bln to $ 96bln so there’s been a cash outflow of $ 5bln:

CapitalIQ, my estimates, Curr. Port. Of Leases, note 3, 10Q Q320, Curr. Port. Of LT Debt, note 5, 10Q Q320

So the evidence is that the increase in net income is only a result of the massive increase in assets not showing up in the P&L yet. Actually Amazon is losing money. Even in a year when people are being forced to use it.

Devi fare login per commentare

Accedi